NFT Bear Market Survival Guide… Crypto Winter Is Coming

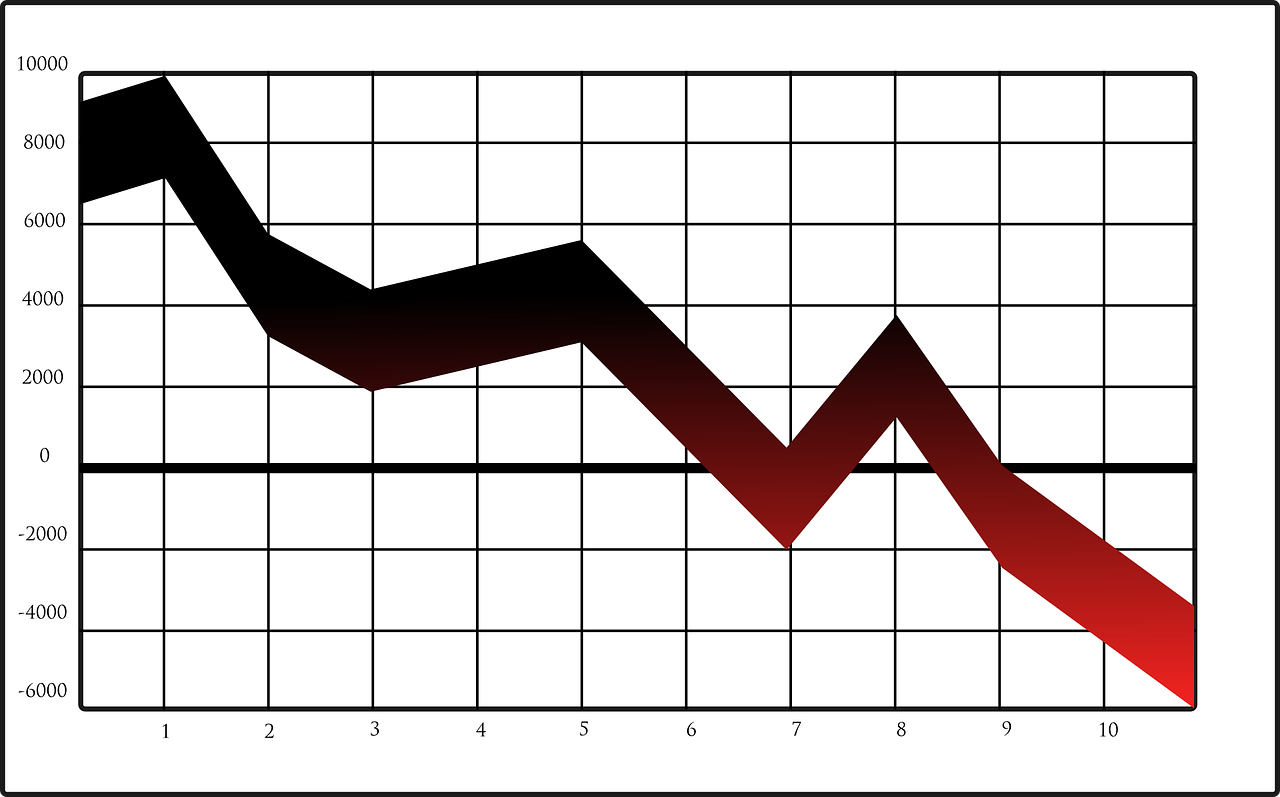

If you’ve been keeping your eye on anything in the NFT markets – you’ll know the last few months have been – well, more than a bit rough. As summer 2022 heated up and we all lit our BBQs… the markets had other ideas. Crypto Winter has been ice-cold. So, we’re officially in a bear market, and the NFT marketplace has taken some serious punches. In August, NFTs reached a new low, with a whopping $4.14 billion decrease in trading volume compared with January of this year. At the same time, the average sale value tumbled by 77%. Yep, you read that right. Even Bluechip NFT projects have suffered; although some still managed to launch strong in a bearish market (we see you, Moonbirds!). So will NFTs survive the bear market? Is the NFT market dead? And how do you spot a bear market before it’s too late? We’ve put together an NFT bear market survival guide to answer all your burning questions.

What is a bear market?

Bears are cuddly and friendly, right? Wrong. Bears are wild animals, and should not be approached! Just as the perception of our real-life furry friends is, well, skewed (we’ll thank Goldilocks for that one) – you’d be forgiven for assuming that a bear market sounds a bit adorable, or even enticing. Spoiler alert – no one likes a bear market.

‘Bear market’ is a stock market term that’s been carried over to NFT land.

It refers to a prolonged period of price declines in a stock or entire market – usually at 20% or more down from a recent high. As NFTs are a ‘risk on asset’, the losses can be much higher – indeed, the reality has been closer to 80 than 20 percent.

So how do you know you’re in a bear market? Well, in this case, traders began to realize that both cryptocurrencies and NFTs – while not hooked to federal reserves – were following the same pattern as the stock market – and responding pretty quickly to market forces.

The decline in NFT prices became noticeable in late spring, as the United States Federal Reserve raised interest rates, and Terra’s LUNA collapsed – (currently, there’s an arrest warrant out for Luna’s CEO, who insists he’s not hiding – but that’s a story for another day!).

These events sent shock waves through the DeFi market, as the realization set in: we were in a bear market.

There was also a realization that cryptocurrencies – and thus the value of NFTs – were following more of a reactionary path than imagined.

Bitcoin and the rest of crypto fell with the rest of the stock market amidst inflation fears – when many in the space predicted cryptocurrencies could do the exact opposite.

What threats do bear markets pose to the NFT marketplace?

For NFT traders, it’s all about floor price. So, when a project launches and is successful, traders and NFT aficionados rush to buy their slice of the pie.

After the initial hype, all NFTs see some form of sell-off. But what happens when no one holds and the sales continue? Well, it’s a race to the bottom: the price of the asset (known as the floor price) drops… and drops…. Until it’s essentially worth nothing.

As the bear market spread its wings this summer, and NFT lovers began to bunker down, the mood on crypto Twitter was glum.

“We’re going to zero!” The more anxious collectors tweeted, while others were quick to reassure. With investments – and NFTs too – doubt is not the currency to be trading in.

But it’s true that bear markets can pose an existential threat to a marketplace as young as NFTs. We’re in the early, early days of this technology – and nothing is 100% certain.

The bear market in NFTs right now is reminiscent of the Initial Coin Offering (ICO) hype that some will remember from 2017 – and it wasn’t just scams that fell out of the water then. Legitimate projects with competent and driven teams just evaporated.

Many of today’s NFT projects are destined for that same fate. But these cycles – bear to bull – boom to bust – are inherent in any new technology. And while projects may come and go, blockchain, the underlying technology, is steadfast, resilient, and unwavering.

How to invest during a bear market?

We’re not here to give investment advice – but bear markets can be a great way to learn the ropes, and understand more about the space.

We picked the brains of 0xDorsal – the (undoxxed) founder of Integral – who had some important tips.

Take notes, learn from the cycles, and bank that knowledge for next time around, he explains:

“One of the most important lessons is that crypto is this generation’s stock investment. Bear markets can help us build muscle memory so that we’ll have a better understanding of “cycles” in the future.”

It’s no secret that any markets – be they stock markets or NFTs, can be cutthroat. But with NFTs, the volatility factor is tenfold.

“You may not always invest in crypto, but the lessons here are invaluable: how to evaluate fundamentals, how to identify powerful memes, how to participate in community building… These are the key skills of future investors, and they are the most important lessons you can get in your lifetime”.

What can be done to ensure the longevity of NFTS?

Mass adoption powered by accessible real-life utilities, big brand buy-ins, and increased usability (i.e. buying NFTs on your Mastercard, rather than with a crypto wallet) will all shore up the future and permanence of NFTs. Luckily, all of these are very much en route.

While projects are vulnerable in today’s bear market, we’re as bullish as ever on the future NFTs – this transformative technology simply ain’t going anywhere.

Featured Image by Clker-Free-Vector-Images from Pixabay